Exploring the Benefits of PrimeXBT Trading Markets

As the world of cryptocurrency and financial trading continues to expand, platforms such as PrimeXBT Trading Markets https://primexbt-ltd.com/ emerge as pivotal in enabling traders to capitalize on diverse market opportunities. PrimeXBT is one such platform that provides an extensive trading environment for both novice and experienced traders, characterized by a variety of unique features that distinguish it in the rapidly evolving trading landscape.

PrimeXBT stands out in the trading universe thanks to its comprehensive suite of trading tools and functionalities. Initially launched in 2018, the platform has since garnered a significant user base, proving its credibility and reliability in the highly competitive market. By offering a wide range of trading instruments, including cryptocurrencies, traditional fiat currencies, commodities, and indices, it caters to a broad spectrum of trading interests.

Multi-Asset Trading

One of the primary advantages of PrimeXBT is its multi-asset trading capabilities. Traders can access over 100 trading instruments, which allows them to diversify their portfolios effectively. This range not only includes popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin, but also traditional assets such as Forex pairs, commodities like gold and oil, as well as stock indices. The availability of such a diverse array of instruments means that traders can implement various strategies, whether they are looking to hedge their positions, capitalize on market volatility, or invest for the long term.

Leverage Trading

Another notable feature that PrimeXBT offers is the opportunity for leverage trading. Leverage enables traders to gain exposure to larger positions than their initial investment would allow. On PrimeXBT, users can enjoy leveraged trading of up to 100x, depending on the asset class. While this can amplify profits, it’s essential for traders to be aware of the commensurate risk; higher leverage can lead to substantial losses as well. Therefore, prudent risk management strategies should always be a cornerstone of any trading approach.

User-Friendly Interface

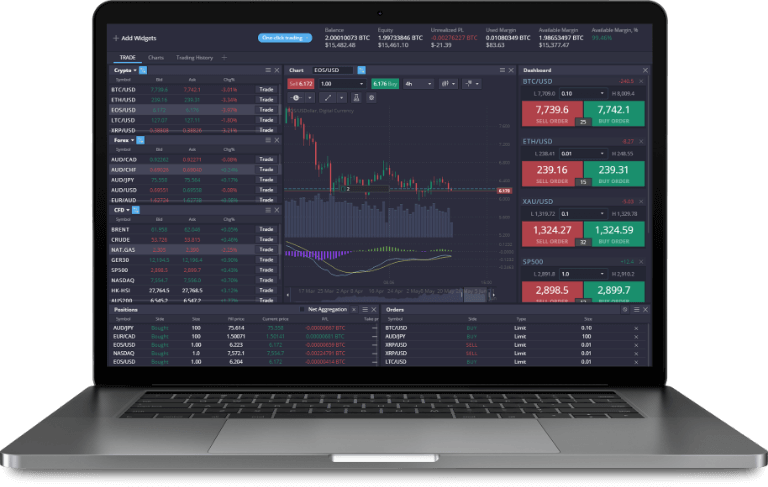

The platform’s user interface is designed to be intuitive and easy to navigate, making it accessible for traders of all experience levels. Whether you are a seasoned trader or just starting, you will find that the layout of the PrimeXBT platform allows for quick access to important features. Charts, trading history, and market analysis tools are all available at a glance, facilitating informed decision-making. Furthermore, PrimeXBT places a strong emphasis on providing real-time market data, which is crucial for making timely trading decisions.

Security Features

Security is a paramount concern in the realm of online trading, and PrimeXBT addresses this by implementing robust security measures to protect users’ funds and data. The platform utilizes cold storage for the majority of funds, minimizing the risk of hacking and theft of assets. Additionally, two-factor authentication (2FA) adds an extra layer of security, ensuring that only authorized users can access their accounts. With these precautions in place, traders can feel more confident in the safety of their investments.

Educational Resources

For many traders, especially those new to the space, understanding the mechanics of trading can be daunting. Recognizing this, PrimeXBT has developed a range of educational resources designed to empower users with knowledge. The platform features an extensive library of articles, webinars, and tutorials that cover various aspects of trading, whether technical analysis, risk management, or market indicators. This commitment to trader education helps to cultivate a more knowledgeable trading community.

Customer Support

Effective customer support is an essential aspect of any trading platform. PrimeXBT prides itself on providing responsive and knowledgeable customer service to assist users with their inquiries or issues. The support team is available 24/7 through various channels, including live chat and email, ensuring that help is always just a message away. This level of support can be a crucial factor for traders who may encounter challenges or require guidance while navigating the platform.

Conclusion

In summary, PrimeXBT offers a comprehensive trading environment that is equipped with a multitude of features designed to enhance the trading experience. With its diverse range of trading instruments, high leverage options, user-friendly interface, robust security measures, rich educational resources, and reliable customer support, it’s easy to see why it has become a favored choice among traders globally. As the trading landscape continues to evolve, platforms like PrimeXBT will undoubtedly play a central role in shaping how individuals engage with financial markets.