The Psychology of Forex Trading Mastering Your Mind for Success 1922671188

The Psychology of Forex Trading: Mastering Your Mind for Success

In the fast-paced world of Forex trading, having a solid strategy and understanding technical indicators is crucial. However, one of the most significant factors that can determine your success or failure in the Forex market lies in your psychology.

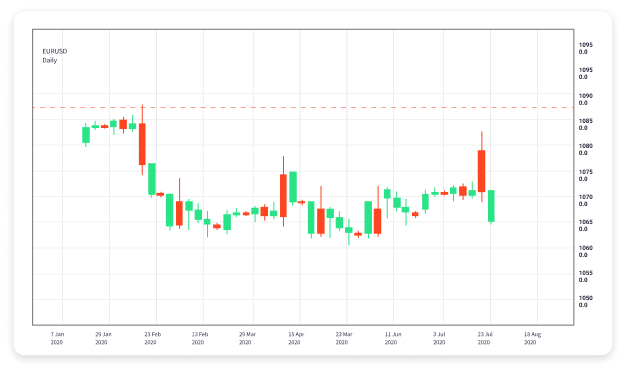

forex trading psychology Top MT4 Trading Apps can assist traders with analysis, but understanding one’s mental state is often overlooked. This article dives into the essential aspects of trading psychology, emphasizing the importance of emotional management, discipline, and psychological strategies that can set traders on the path to success.

Understanding Trading Psychology

Trading psychology refers to the emotional and mental factors that influence a trader’s decisions and actions. It encompasses how traders respond to losses, wins, and market volatility. The mind plays an essential role in making trading decisions, often leading to errors if not properly managed. Fear, greed, and overconfidence are common emotions that can impact trading behaviors adversely.

The Role of Emotions in Trading

Emotions like fear and greed are natural responses that every trader encounters. Fear can cause hesitation and lead to missing out on profitable trades, while greed may push traders to take unnecessary risks. It’s crucial to recognize these emotions and develop strategies to manage them effectively.

Fear of Loss

One of the primary fears in trading is the fear of loss, which can cripple decision-making. Traders may exit positions too early to avoid losses, potentially leaving profits on the table. A practical approach to overcoming this fear involves setting clear trading plans that include stop-loss orders to manage risk without emotional interference.

Greed and Overtrading

On the opposite spectrum lies greed, which can lead to overtrading. Many traders, after experiencing a few wins, may become overly confident and increase their position sizes recklessly. This often leads to devastating losses. A disciplined approach is essential, where traders adhere to their trading plan regardless of emotional impulses.

The Importance of Discipline

Discipline is a cornerstone of successful trading. It entails sticking to a well-defined trading plan, no matter how the market behaves. Discipline helps traders avoid impulsive decisions driven by short-term emotions.

Here are some strategies for cultivating discipline in your trading routine:

- Create a Trading Plan: Outline your trading goals, risk management rules, and entry/exit strategies. A solid plan serves as a guideline to follow under pressure.

- Set Realistic Goals: Establish achievable profit targets and accept that losses are part of trading. Adjust your mindset to focus on long-term success rather than short-term gains.

- Keep a Trading Journal: Recording your trades along with your thoughts and emotions can help identify patterns in your emotional reactions and enhance self-awareness.

Coping with Psychological Strain

Trading can be mentally taxing, and prolonged exposure to market stress can lead to burnout or emotional fatigue. To cope with this strain, traders should incorporate self-care practices into their routines. This may include:

- Regular Breaks: Step away from the screen periodically to recharge and prevent fatigue.

- Physical Exercise: Engage in physical activities to relieve stress and improve mental clarity.

- Meditation and Mindfulness: Techniques to calm the mind and cultivate emotional resilience.

Developing a Healthy Mindset

Cultivating a healthy mindset is essential for navigating the emotional landscape of trading. Mindset affects how traders perceive challenges and setbacks. Viewing losses as learning opportunities rather than failures can shift perspective and enhance resilience. Here are ways to develop a growth mindset:

- Embrace Failure: Understand that losses are a natural part of the trading process. Analyze what went wrong and use this insight to improve.

- Stay Informed: Continuous education in trading strategies and market analysis can build confidence and decrease anxiety.

- Visualize Success: Positive visualization techniques can help reinforce confidence and prepare mentally for various market scenarios.

Conclusion

The psychology of Forex trading is a complex but pivotal aspect of successful trading. Emotions like fear and greed are common challenges that traders must learn to manage effectively. Through discipline, the cultivation of a healthy mindset, and effective coping strategies, traders can navigate the psychological hurdles of trading. Mastering your trading psychology is equally essential as developing technical skills; this combination can lead to sustained success in the Forex market.

Remember, trading is as much about understanding yourself as it is about understanding the markets. By investing time and effort into improving your trading psychology, you set the stage for a more profitable and fulfilling trading experience.

Deixe uma resposta

Want to join the discussion?Feel free to contribute!