Trading Strategy with Envelope Maximizing Profits in Financial Markets

Trading Strategy with Envelope: Unlocking Potential in Financial Markets

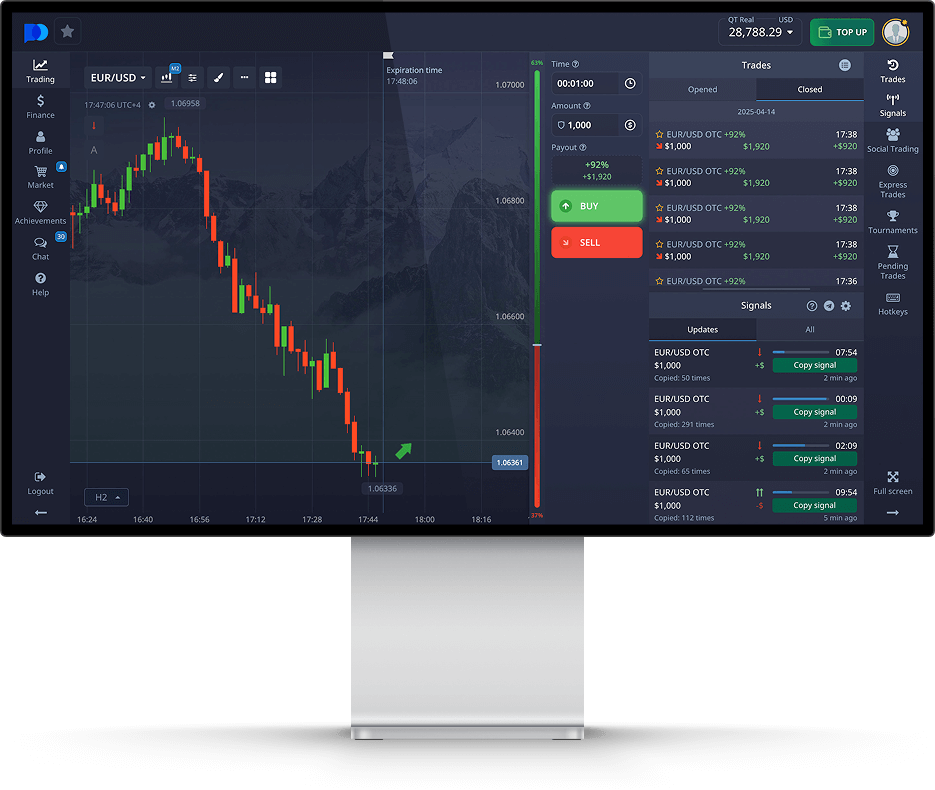

If you are seeking a powerful method to enhance your trading performance, consider implementing an Trading Strategy with Envelope торговая стратегия с Envelope into your trading routine. The Envelope indicator, a versatile and adaptable tool, allows traders to identify potential price movements and generate actionable insights in various markets. This article will delve deep into the intricacies of the Envelope indicator and how you can effectively utilize it in your trading strategy.

Understanding the Envelope Indicator

The Envelope indicator is a technical analysis tool that consists of two lines plotted above and below a central moving average. These lines represent bands that reflect the volatility of a financial asset’s price. The distance between the central moving average and the outer bands can be adjusted to cater to a trader’s specific strategy, making the Envelope a highly flexible indicator.

How Envelope Works

To understand how to effectively use the Envelope indicator, it’s crucial to recognize its operational mechanics. The outer bands of the Envelope are typically constructed by adding and subtracting a predetermined percentage from the moving average, thereby highlighting levels of potential price reversal. When the price crosses the upper band, it may indicate overbought conditions, while crossing below the lower band may suggest oversold conditions.

Setting Up the Envelope Indicator

To set up the Envelope indicator, follow these steps:

- Choose a financial market you wish to trade in, whether that be stocks, commodities, or forex.

- Select a time frame that aligns with your trading strategy, such as daily, hourly, or 15 minutes.

- Apply a moving average (commonly a Simple Moving Average or Exponential Moving Average) to the chosen asset.

- Define the envelope settings by specifying the percentage deviation from the moving average to establish your upper and lower bands.

Developing a Trading Strategy with Envelope

Creating a robust trading strategy with the Envelope indicator involves defining entry and exit points based on the signals generated by the indicator. Below are common strategies that traders utilize:

1. Trend Following Strategy

This strategy involves identifying the trend direction through the moving average while using the Envelope to determine entry and exit points. If the price remains above the moving average, you would look for buying opportunities as the price approaches the lower Envelope band. Conversely, if the price stays below the moving average, you would seek selling opportunities as it approaches the upper band.

2. Reversal Trading Strategy

Traders often anticipate reversals when the price hits the upper or lower Envelope bands. This strategy includes placing trades when the price hits these bands, expecting a reversal back towards the moving average. It is crucial to incorporate additional confirmation signals, such as candlestick patterns or other indicators, to increase the reliability of this strategy.

Combining Envelope with Other Indicators

While the Envelope is a powerful tool on its own, combining it with other indicators can enhance its effectiveness. Here are a few suggestions:

- Relative Strength Index (RSI): Utilize the RSI in conjunction with the Envelope to confirm overbought or oversold conditions before entering trades.

- Moving Average Convergence Divergence (MACD): This momentum indicator can help confirm trend strength and direction, further validating the signals from the Envelope.

- Volume Indicators: An increase in trading volume can indicate strong momentum, providing additional support to your Envelope-based trades.

Risk Management with Envelope Strategy

Implementing effective risk management is crucial when trading with the Envelope strategy. Here are some essential tips:

1. Set Stop-Loss Orders

Always determine where to place a stop-loss order to limit potential losses. Placing the stop-loss just beyond the outer band may provide protection against extreme market movements.

2. Position Sizing

Calculate your position size based on your trading account balance and risk tolerance. This ensures that you do not risk more than you can afford in any single trade.

Backtesting and Optimization

Before executing trades with the Envelope strategy, it is prudent to backtest your strategy on historical data to assess its performance under different market conditions. Use demo accounts or trading simulators to practice and optimize your trading approach based on the findings from your backtests.

The Importance of Psychology in Trading

While technical indicators like the Envelope are essential in decision-making, trading psychology plays a critical role in the trader’s success. Maintaining discipline, patience, and emotional control are fundamental traits that every trader should cultivate. Avoid making impulsive trades driven by fear or greed, and trust your strategy to yield results over the long run.

Conclusion

The Envelope trading strategy serves as an excellent framework for traders aiming to navigate the complexities of the financial markets. By effectively leveraging the Envelope indicator alongside other analytical tools and maintaining a robust risk management strategy, traders can enhance their chances of success. As with any trading approach, continuous learning, practice, and adaptation to the ever-changing market conditions are essential to prosper in trading. Start integrating the Envelope strategy into your trading arsenal today and unlock its potential.

Deixe uma resposta

Want to join the discussion?Feel free to contribute!