The Ultimate Guide to Options Trading in Forex 1672788454

The Ultimate Guide to Options Trading in Forex

Options trading in Forex represents a unique opportunity for traders who understand the complexities of both the Forex and options markets. Unlike stock options, Forex options offer unique features and flexibility that can be strategically leveraged to optimize investment returns. In this article, we will delve deeply into the essentials of options trading in forex, explore various strategies, and introduce you to resources like options trading forex Trading Terminal that can aid you in your trading journey.

Understanding Forex Options

Before diving into strategies, it’s essential to understand what Forex options are. Forex options are contracts that give traders the right, but not the obligation, to buy or sell a currency pair at a predetermined price before a certain date. They come in two types:

Call options, which allow the purchase of a currency pair, and

Put options, which allow the sale of a currency pair.

Key Terms to Know

To be successful in options trading, it’s important to grasp some key terms:

- Strike Price: The price at which the trader can buy or sell the underlying asset.

- Expiration Date: The last date on which the option can be exercised.

- Premium: The cost of purchasing the option.

- In-the-money: A term that describes an option that has intrinsic value.

- Out-of-the-money: An option that has no intrinsic value.

Benefits of Forex Options Trading

There are several advantages to using options in Forex trading, including:

- Leverage: Options allow traders to control larger positions with a smaller upfront investment.

- Flexibility: Traders can use various strategies tailored to their risk tolerance and market outlook.

- Risk Management: Options can be used to hedge against adverse market movements, minimizing risks.

- Profit from Volatility: Traders can profit from market fluctuations without necessarily needing a directional market move.

Strategies for Trading Forex Options

When trading Forex options, it’s beneficial to employ various strategies based on market conditions and personal trading goals. Here are some popular strategies:

1. Covered Call

This strategy involves holding a long position in a currency pair while simultaneously selling a call option on the same pair. It’s especially useful in a sideways market, generating additional premium income while limiting potential losses.

2. Protective Put

A protective put involves buying a put option on a currency pair you own, providing downside protection. If the market falls, the put option increases in value, offsetting some losses from the currency position.

3. Straddle

A straddle is a strategy where a trader simultaneously buys a call and a put option at the same strike price and expiration date. This strategy is effective during periods of high volatility when significant price movement is expected in either direction.

4. Iron Condor

An iron condor involves selling an out-of-the-money call spread and an out-of-the-money put spread concurrently. This strategy profits when the market remains in a defined range, making it ideal for markets with lower volatility.

Risks of Trading Forex Options

While the potential for profits in Forex options trading can be significant, it’s crucial to acknowledge the associated risks:

- Loss of Premium: The most you can lose when buying an option is the premium paid if the option expires worthless.

- Complexity: Understanding various strategies and terms can be challenging, especially for beginners.

- Market Risk: Like any form of trading, Forex options are subject to market fluctuations, which can lead to losses.

- Liquidity Risk: Some options might be less liquid than others, making it harder to enter or exit positions.

Tools and Resources for Forex Options Trading

Various tools and platforms can assist traders in managing their Forex options trades effectively. A platform like Trading Terminal provides a wealth of information and tools tailored for traders seeking to navigate the Forex options market. Key features to look for in your trading platform include:

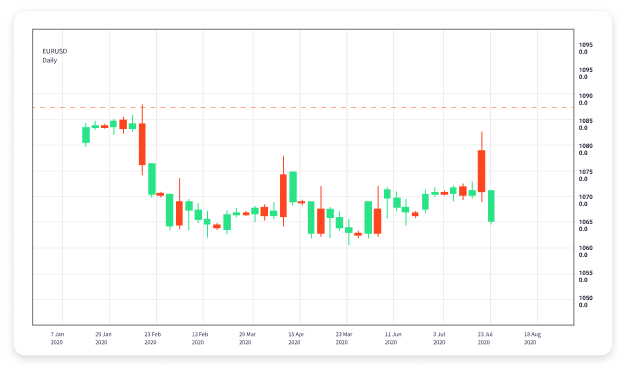

- Real-Time Data: Access to up-to-date market prices helps traders make informed decisions.

- Advanced Charting: Visualizing price movements and trends can aid in technical analysis.

- Risk Management Tools: Features that help assess and mitigate risk are essential for successful trading.

- Educational Resources: Access to webinars, articles, and tutorials can help new traders build their knowledge.

Conclusion

Options trading in Forex offers exciting opportunities for those who understand the market’s intricacies and are willing to embrace strategies that align with their trading goals. By learning the fundamental concepts, benefits, and risks associated with Forex options, you can position yourself to capitalize on market movements while managing potential losses. Utilizing resources such as Trading Terminal can significantly enhance your trading experience and propel you toward success in the Forex options market.

Deixe uma resposta

Want to join the discussion?Feel free to contribute!